If you were injured in a car accident, you may be entitled to compensation for your medical expenses. Importantly, even relatively minor injuries can result in tens of thousands of dollars in medical bills. Car accidents that cause more serious bodily injuries, such as dismemberment or paralysis, can easily rack up hundreds of thousands of dollars in costs. Unfortunately, it may take months, if not years, to negotiate a settlement with an insurance company. In the meantime, you are responsible for paying your own bills.

This may be a significant concern for many Americans. According to the U.S. Census Bureau, prior to the Pandemic, more than 29 million people in the United States lack health insurance. Without health insurance, you may be left asking how are you supposed to pay for medical treatment following a car accident?

Injured in a Car Accident with no Health Insurance?

First, it is important to keep in mind hospitals are legally required to provide emergency medical treatment, regardless of your insurance status or ability to pay. The Emergency Medical Treatment and Labor Act (“EMTALA”) is a federal law that requires hospitals to stabilize and treat anyone coming into an emergency department.

While you cannot be turned away from an emergency room following a car accident in Colorado, you will receive a bill for your visit. Hospitals are used to dealing with patients who cannot afford to pay a substantial medical bill, which is why they often offer a variety of options to reduce medical costs. If you have a medical balance without health insurance, consider taking the following steps:

1. Check Hospital Bill for Errors

Medical bills can often have errors that should be removed as charges. To check for potential errors, you should ask the billing department to send you an itemized bill for your care. The itemized bill should list each procedure you received, as well as the appropriate billing code. It is possible the service provided was coded incorrectly. If there is a charge for a procedure you did not receive, request the billing department remove the charge.

2. Ask the Hospital if you Qualify for Financial Aid

Colorado law requires nonprofit hospitals to offer financial assistance programs, along with information about how to apply for such help. For example, Medicaid is a health insurance program funded by the federal government and run by Colorado that helps people who cannot afford medical treatment. If you do not have affordable health insurance, or if you lose your health insurance for any reason, you may qualify for Medicaid coverage. If eligible, you are guaranteed coverage for inpatient and outpatient hospital services, doctor visits, x-rays, ambulance visits, home health care, and so on. Medicaid may also cover your prescription medication. The caveat, however, is that you must be covered by Medicaid at the time of service. For more information about how to apply for Medicaid in Colorado, click here.

3. Ask the Hospital to Accept a “Cash Price”

If you do not qualify for financial aid and still cannot afford the cost of medical care in Colorado, you could consider negotiating your bills directly with the billing department. Consumers who are interested in negotiating their medical bills may be surprised to learn that hospitals are sometimes willing to accept a fraction of the outstanding balance for an upfront lump sum payment. If you have an outstanding balance, simply present to the billing department and offer to pay the bill for a 50% discount but be sure to indicate you can pay it immediately. It may also be helpful for you to be transparent about why you are asking for help.

4. Ask the Hospital to Accept Installment Payments

Hospitals often allow patients to pay installments on a balance. Hospitals may be willing to break your hospital bill into more manageable, interest-free monthly payments without a credit check. This is an important option because, if you do not set up a payment plan, the medical bill will most likely be sent to collections, which could hurt your credit score, even if the car accident was not your fault. Remember, medical facilities are just like any other business. They seek a profit so they need to make money to continue their operations. Keep in mind that if you enter a payment plan, you may no longer qualify for a discount through a cash payment.

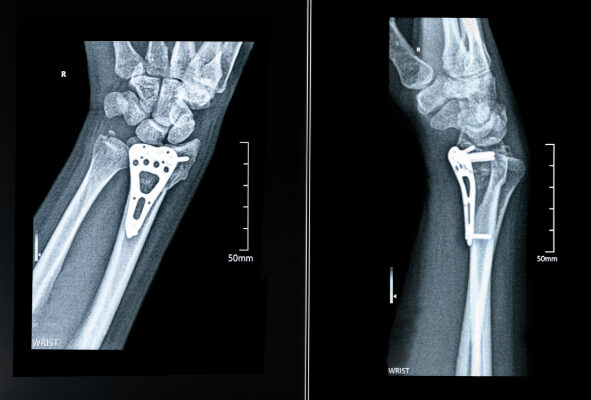

5. Pay for Medical Care with Your Car Insurance

In Colorado, medical payments coverage (“Med Pay”) is optional insurance that covers you and your passengers’ medical expenses up to the coverage limits, regardless of who was at fault for the car accident and even if it was a single car accident. Med Pay covers ambulance fees, deductibles, co-pays, doctor and hospital visits, x-rays, and surgeries. This is a great option even if you do have health insurance because you can avoid paying high deductibles or co-pays. In addition, Med Pay pays out immediately. However, Med Pay is not going to cover all medical treatment, especially if your medical bills exceed your coverage.

6. Pay for Medical Care with a Lien

Another option is having the medical providers place a lien on your personal injury claim. A lien is a type of pre-emptive claim a creditor makes against future financial proceeds by a debtor to be compensated for money owed by the debtor. In a lien agreement, the medical provider agrees to provide medical care and, in return, the injured party agrees to reimburse the medical provider with proceeds from a personal injury settlement. This is a legal right of claim stating medical providers are owed money because they performed services for you but did not get paid. This is typical when a tortfeasor is expected to legally pay you through a personal injury settlement. Unfortunately, not all hospitals, doctors, or medical providers will work on a lien basis because they understand liens are risky. By way of example, if a provider renders care in exchange for a lien, and the personal injury victim loses the personal injury case, the provider can only get paid for the services by the victim.

Do Not Settle Your Personal Injury Claim Prematurely

At the end of the day, the tortfeasor’s insurance carrier is responsible for making you whole. Many insurers will attempt to resolve your entire bodily injury claim, including pain and suffering, before you know the full extent of your injuries. If you sign a bodily injury settlement release, the at-fault driver’s car insurance company is no longer responsible for paying your medical bills or pain and suffering. If you need additional medical treatment in the future, you will not be able to renegotiate if you sign a settlement release.

In addition, the at-fault driver’s car insurance carrier will attempt to settle your claim for less than it is worth. For example, the insurance adjuster may balk at the $1,500.00 ambulance bill and $5,000.00 emergency room, and argue the bills are not customary, reasonable, or necessary. In so doing, the insurance adjuster may attempt to settle your claim for significantly less by offering you a total of $3,000.00 to cover your medical bills.

Contact a Colorado Car Accident Lawyer

If you have been injured in a car accident in Colorado, do not fall victim to these predatory efforts. Contact a qualified and knowledgeable personal injury attorney at Bowman Law LLC today at 720.863.6904 or email us for your free consultation. Our lawyers handle a wide range of personal injury cases, including Motor Vehicle Accidents, Bicycle Accidents, Pedestrian Accidents, Slip & Fall Accidents, and Dog Bites & Attacks. We service Arvada, Aurora, Boulder, Broomfield, Denver, Commerce City, Lakewood, Littleton, Thornton, Westminster, Wheat Ridge, and other parts of metropolitan Denver, Colorado.

Return to All News & Resources

Return to All News & Resources